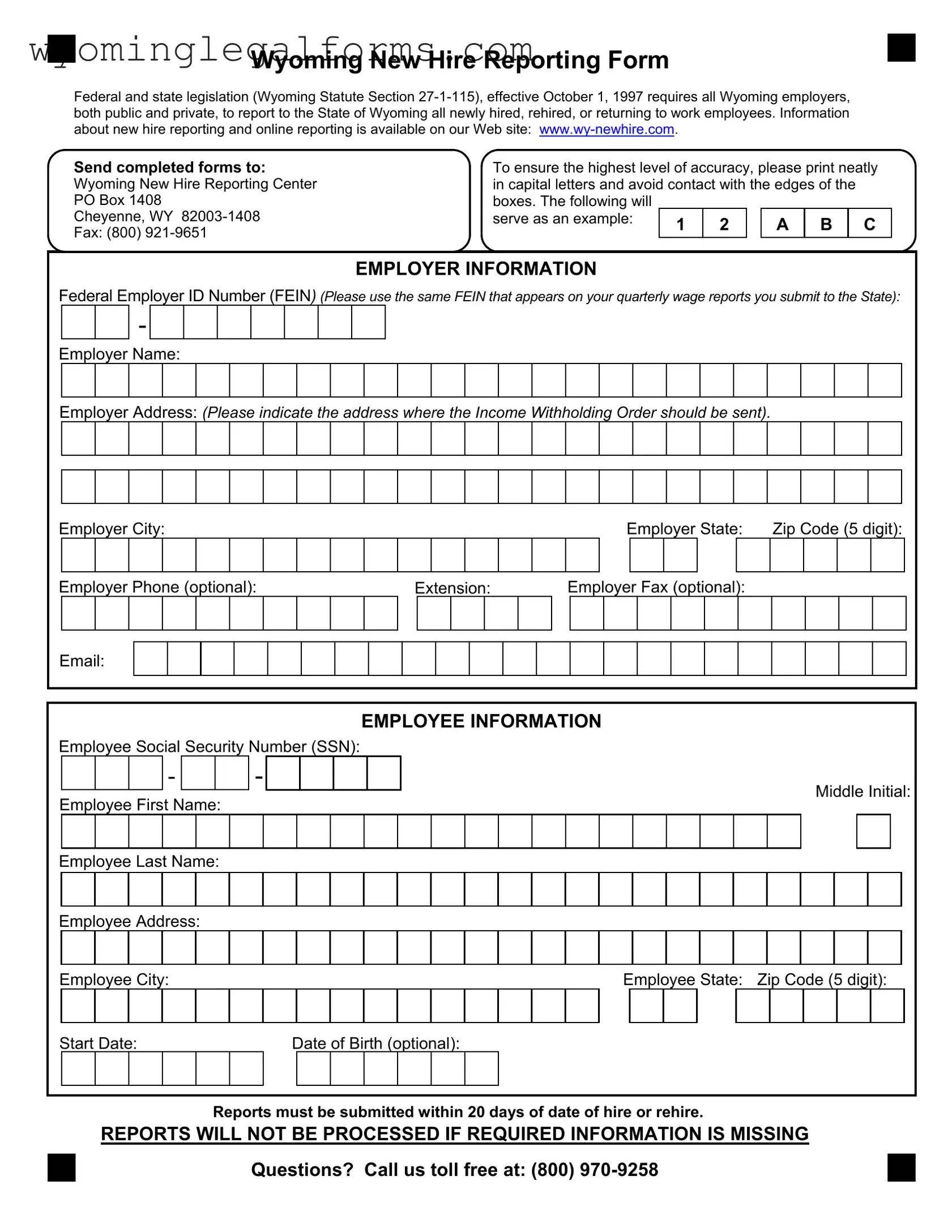

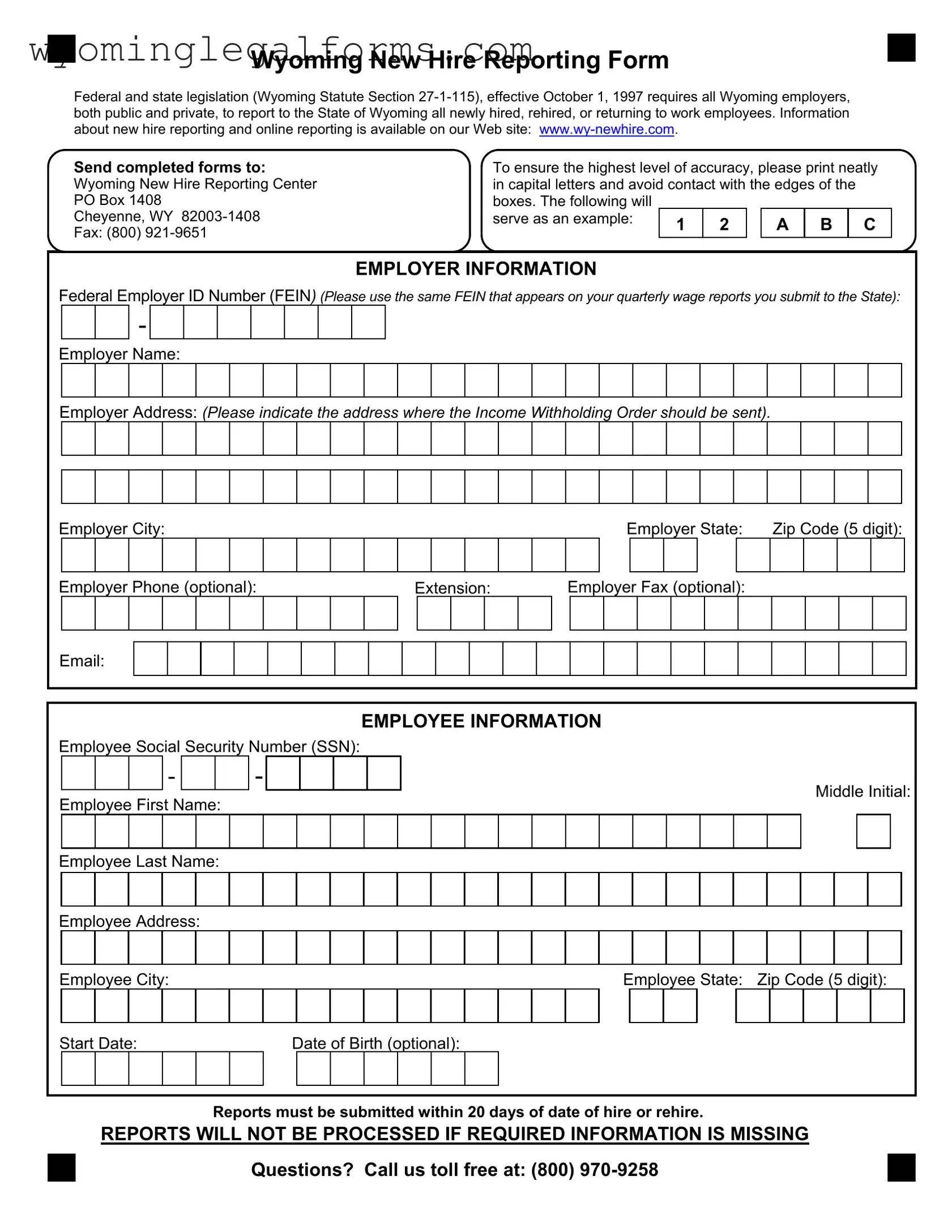

Free Wyoming New Hire Reporting PDF Template

The Wyoming New Hire Reporting Form is a mandatory document that employers in Wyoming must complete for all newly hired, rehired, or returning employees. This requirement, established by Wyoming Statute Section 27-1-115, has been in effect since October 1, 1997. Timely submission of this form helps ensure compliance with state regulations and facilitates various administrative processes.

Access Document Here

Free Wyoming New Hire Reporting PDF Template

Access Document Here

Time-sensitive? Finish the form quickly

Finalize your Wyoming New Hire Reporting online quickly and download it.

Access Document Here

or

➤ PDF File