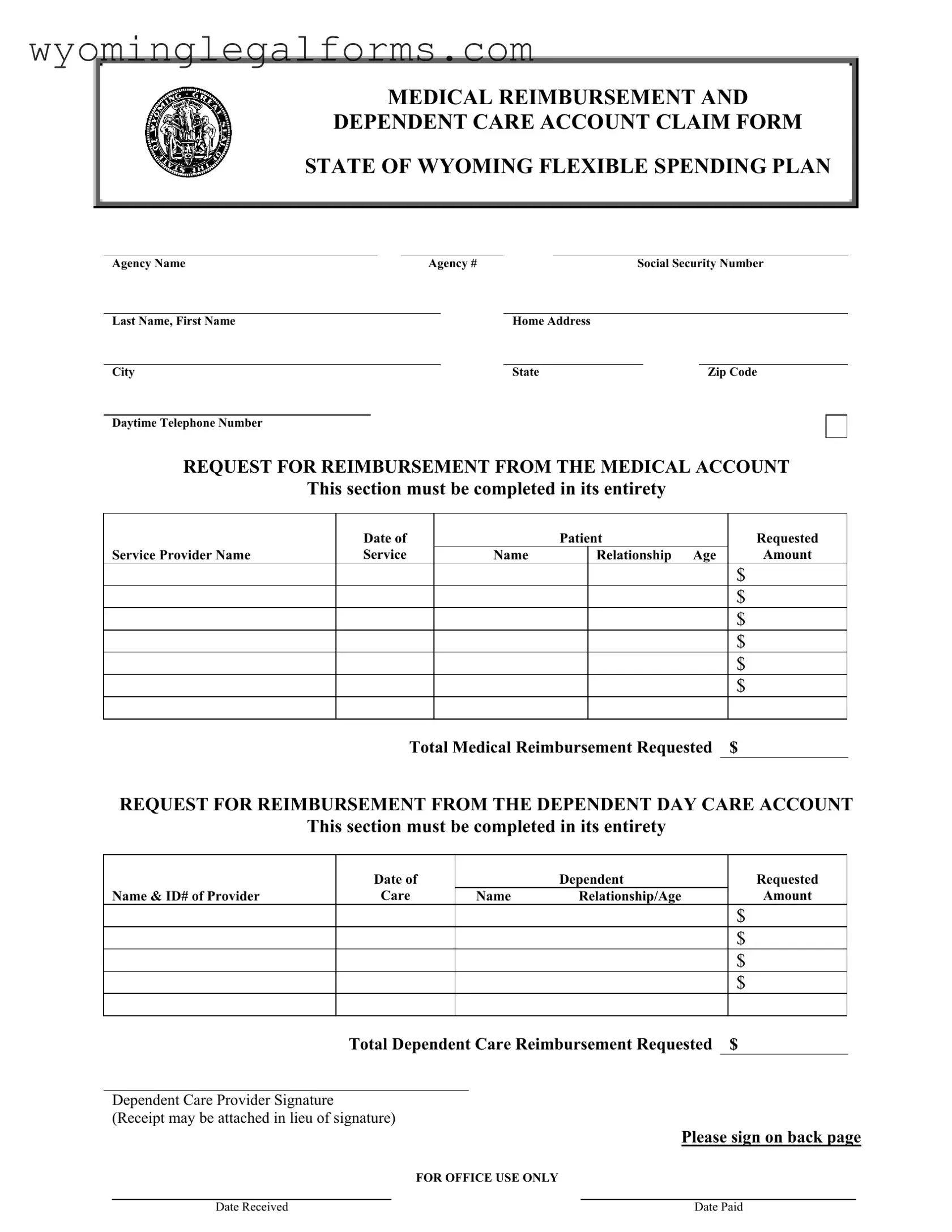

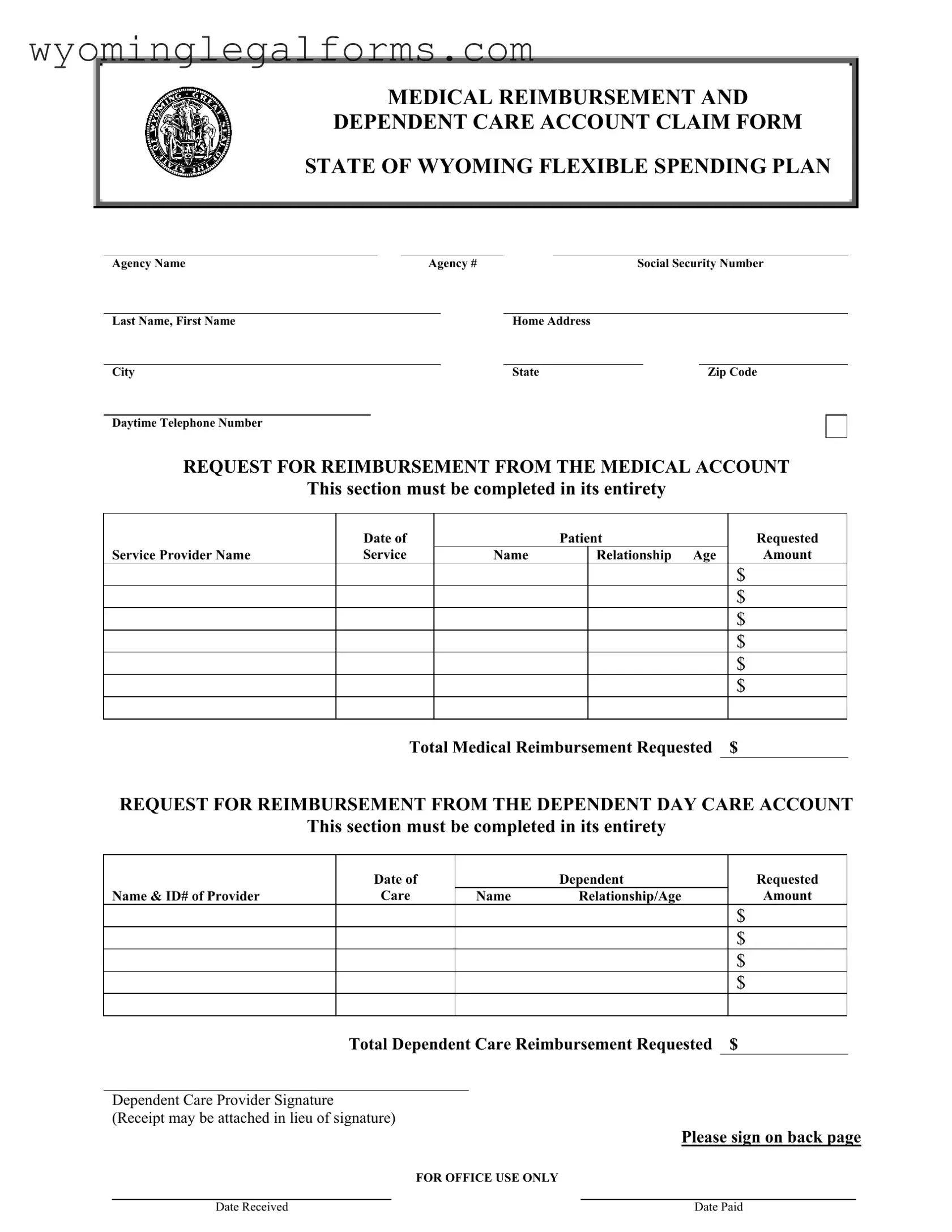

Free Wyoming Medical Reimbursement PDF Template

The Wyoming Medical Reimbursement form is a document used by employees to request reimbursement for eligible medical and dependent care expenses under the state's Flexible Spending Plan. This form must be completed accurately and submitted with the necessary documentation, including itemized invoices and explanations of benefits. Understanding the requirements and procedures outlined in this form is essential for ensuring timely and correct reimbursement.

Access Document Here

Free Wyoming Medical Reimbursement PDF Template

Access Document Here

Time-sensitive? Finish the form quickly

Finalize your Wyoming Medical Reimbursement online quickly and download it.

Access Document Here

or

➤ PDF File