Re: State of Wyoming Vendor Management

Please complete the Wyoming Vendor Management Form and the IRS Form W-9 Request for Taxpayer Identification Number & Certification in order to process payments from the State of Wyoming.

Wyoming Vendor Management Form - Please complete the Wyoming Vendor Management Form in order to assure an accurate, up-to-date record of company financial institution and company contact information. Please verify that all fields are complete and the form has been signed by the primary contact. For specific examples of the primary contact, please refer to the instructions provided. Only original signatures will be accepted. Additionally, the information provided on this form must match that provided on the Form W-9. If you have questions on completing this form, please contact the State Agency with whom you conduct business.

IRS Form W-9 Request for Taxpayer Identification Number & Certification - Please use the current Form W-9, found at http://www.irs.gov/pub/irs-pdf/fw9.pdf. Please complete all applicable sections of the document including taxpayer type, a valid tax identification number, and your signature. Only original signatures will be accepted. The information you provide must match how you are registered with the IRS. Instructions for completing the form are found on the IRS website at the link provided above.

Please send the completed forms to the State Agency with whom you conduct business and remit invoices for payment.

Wyoming State Auditor’s Office

Instructions for Wyoming Vendor Management Form

Please Note: For your protection, we will not accept email or fax to enroll or change Financial Institution Information. Failure to provide the

requested information may delay or prevent your receipt of payments.

Check Box Section (Choose the appropriate option(s))

New Enrollment or Re‐Activation: Complete all information in Parts 1‐4 and attach an original, imprinted voided check. If you do not attach an original, imprinted voided check, you must provide a letter from your Financial Institution on original Financial Institution letterhead providing all required Financial Institution information. Temporary/counter checks will not be accepted.

Vendor Name/Address Change or Add Subsidiary Remittance Address: Complete all information in Parts 1, 3, and 4.

New Direct Deposit Enrollment or Modify Existing Direct Deposit Information: Complete all information in Parts 1‐4 and attach an original, imprinted voided check. If you do not attach an original, imprinted voided check, you must provide a letter from your Financial Institution on original Financial Institution letterhead providing all required Financial Institution information. Temporary/counter checks will not be accepted.

Primary Contact Change or Discontinue Vendor: Complete all information in Parts 1, 3, and 4.

Part 1: Vendor Name & Address

REQUIRED: Provide an updated Form W‐9.

Legal Business (if Company) or Individual Name: The name of the business or person as it appears on the Social Security card or how you are registered with the IRS. Do not abbreviate names.

EIN/SSN: Provide the Employer Identification Number or Social Security Number, as registered with the IRS.

Primary Address: This is the default address and should match what is reported on Form W‐9

Remittance Address: This is the address where payments should be remitted. Complete if different from Primary Address.

Part 2: Direct Deposit Financial Institution Information (DD) – Use only if requesting payment via Direct Deposit

New DD Info (Use only to enroll in DD or modify DD Info):

OType of Account: Check box indicating if account is a savings account or a checking account

OName of Financial Institution: Name of your financial institution

ORouting Number/ABA#: Nine‐digit number identifying the financial institution

OAccount Number: Vendor’s financial institution account number

Previous DD Info (Use only if modification to DD Info): For changes to financial institution information ONLY. All fields are required, see prior step for definitions.

Discontinuation of Direct Deposit: ONLY check box if you are selecting to stop receiving payment via Direct Deposit then complete the Previous Direct Deposit Info section.

Part 3: Vendor Contact Information

Contact Name: Print the name of your primary contact

OIf providing an Employer Identification Number (EIN), on the Form W‐9, contact MUST be someone who can make financial and/or legal decisions for the entity.

OIf providing a Social Security Number (SSN), on the Form W‐9, contact MUST be the individual taxpayer registered with the IRS.

Contact Position Title (if Company) or Self (if Individual): Provide the position title for the primary contact or Self if individual.

Email Address: Provide the email address for the primary contact.

Phone Number: Provide the phone number and extension, if applicable, for the primary contact

Part 4: Vendor Certification and Signature (All fields are required)

Authorized Vendor Contact Signature: Provide an original signature of the primary contact. This MUST match the Vendor Contact Name in Part 3.

Date: Please provide the date this form is signed by the primary contact.

Rev.7/31/15

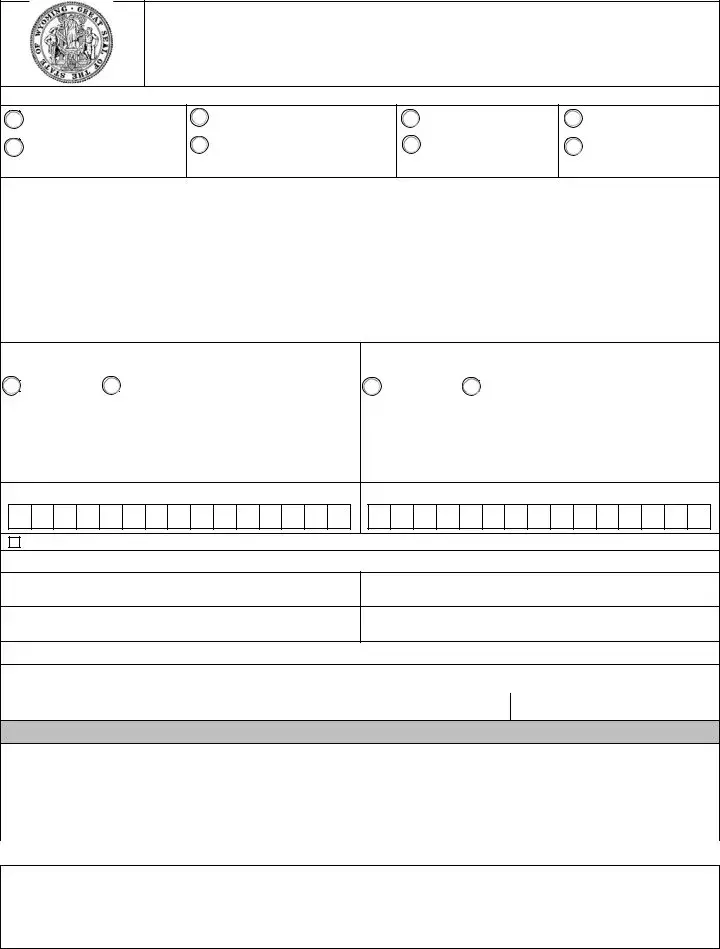

Wyoming Vendor Management Form

Please return this form to the State Agency with whom you conduct business and remit invoices for payment.

New Enrollment

Re-Activation

(Complete Parts 1-4 & Form W-9)

Vendor Name /Address Change

Add Subsidiary Remittance Address

(Complete Parts 1,3,4 & Form W-9)

New Direct Deposit

Enrollment

Modify Existing Direct

Deposit Infomation

(Complete Parts 1-4)

Primary Contact Change

Discontinue Vendor

(Complete Parts 1,3,4)

Part 1: Vendor Name & Address

*Legal Business (if a Company) or Individual Name: |

|

*EIN/SSN: |

|

|

|

|

|

*Primary Address: |

*City: |

*State: |

*ZIP Code: |

|

|

|

|

Remittance Address: (Complete if different from Primary) |

City: |

State: |

ZIP Code: |

|

|

|

|

Part 2: Direct Deposit Financial Institution Information (DD) - Use only if requesting payment via Direct Deposit

|

New Direct Deposit Info (Use only to enrol in DD or modify DD info) |

Previous Direct Deposit Info (Use only if modification to DD info) |

|

Type of Account: |

|

|

|

|

|

|

|

Type of Account: |

|

|

|

|

|

|

|

|

Savings |

Checking |

Savings |

Checking |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name of Financial Institution: |

Name of Financial Institution: |

|

|

|

|

Routing Number/ ABA number: |

Routing Number/ ABA number: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Discontinuation of Direct Deposit |

(Complete previous Direct Deposit Info section) |

Part 3: Vendor Contact Information

*Contact Position Title (if Company) or Self (if Individual):

*Phone Number: |

Extension (if 800 number): |

Part 4: Vendor Certification and Signature

I certify that I am the primary vendor contact for the State of Wyoming and I will submit all change requests.

*Authorized Vendor Contact Signature: |

*Date: |

For State Agency Use Only - REQUIRED

|

* Vendor Number: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

V |

C |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

*Agency Name: |

|

|

*Agency Number: |

|

|

*Agency Address: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

*Contact Name: |

|

|

*Title: |

|

|

*SA Number: |

|

|

*Phone Number: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

* Required Field |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ATTACH ORIGINAL VOIDED IMPRINTED CHECK HERE

If you do not attach an original, imprinted voided check, you must provide a letter from your Financial Institution on original

Financial Institution letterhead providing all required Financial Institution information.