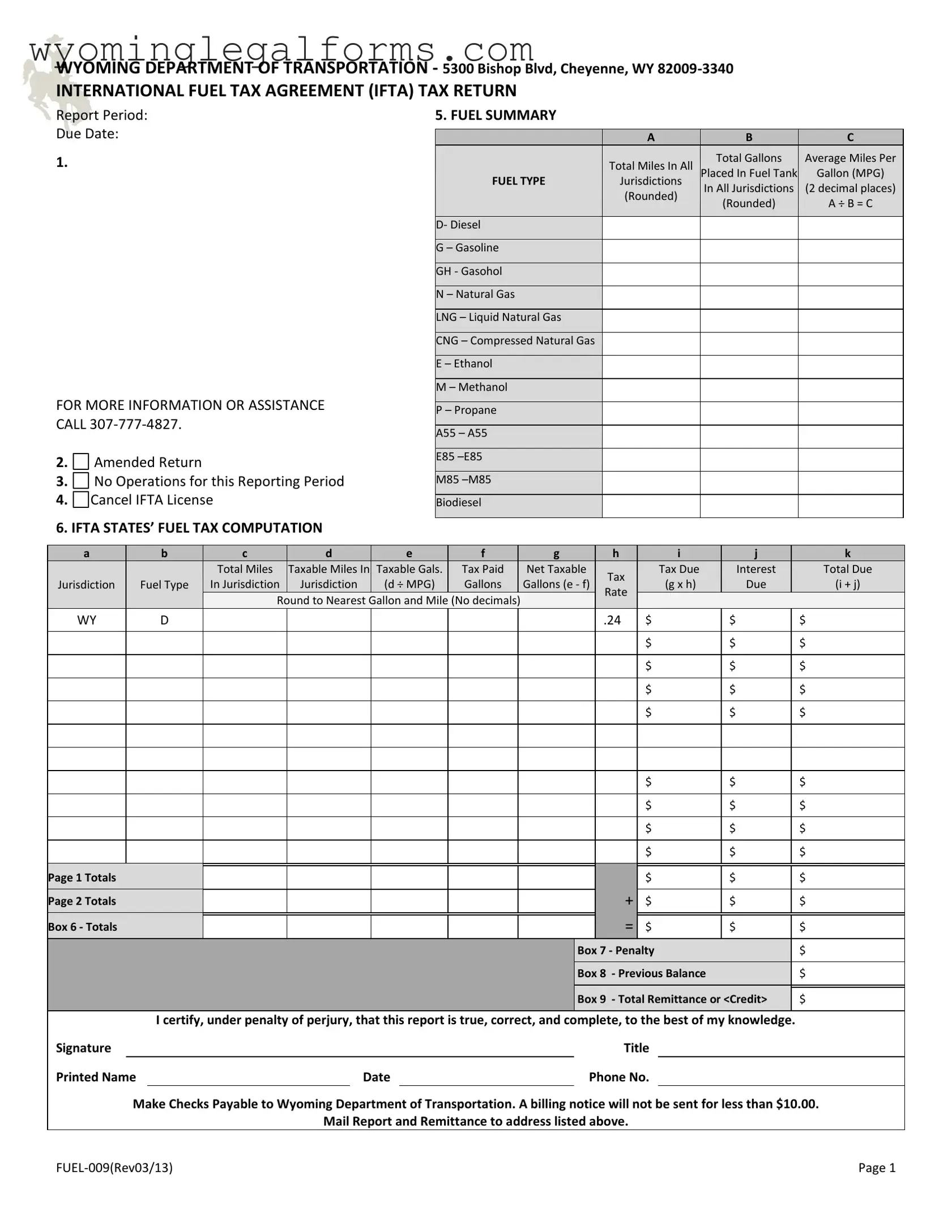

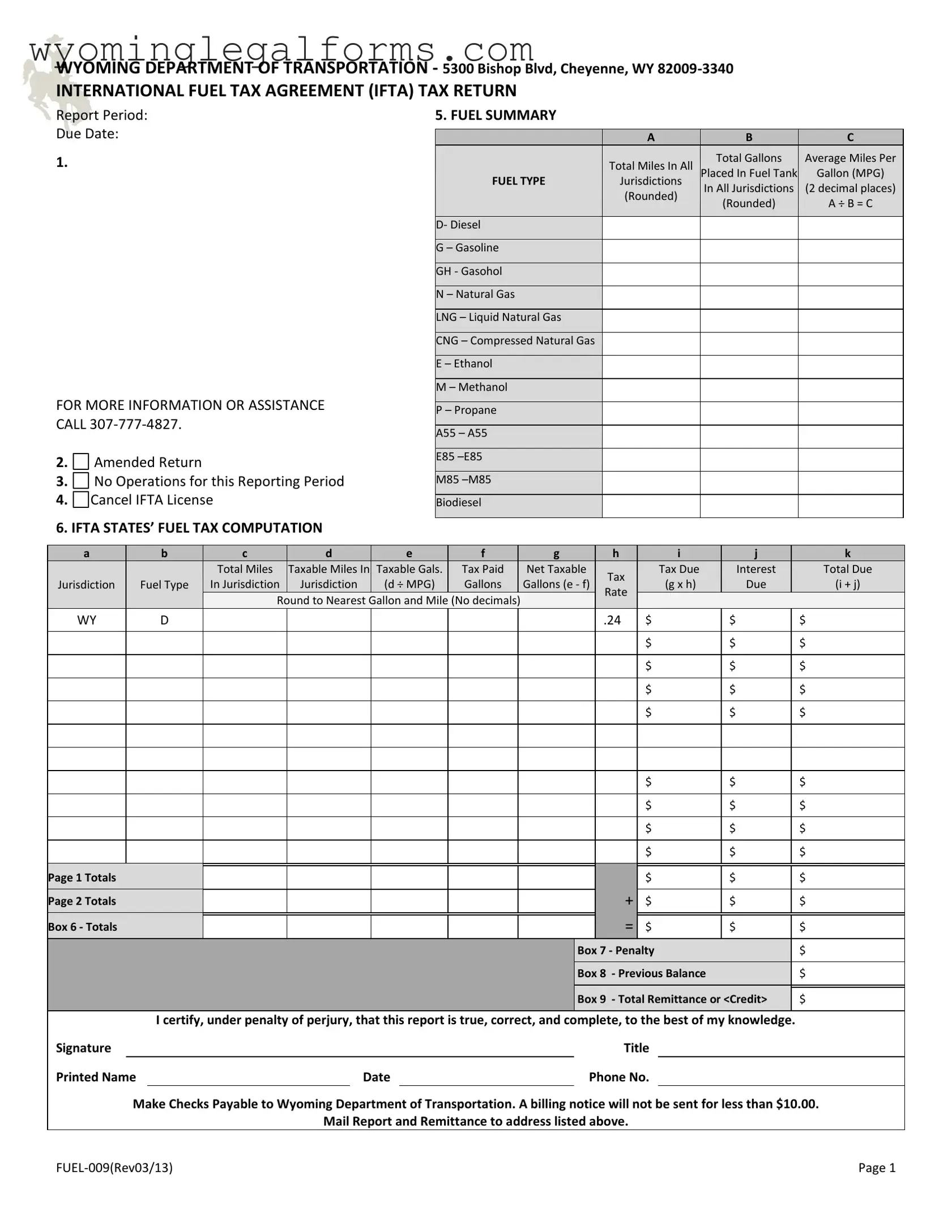

What is the Wyoming IFTA form?

The Wyoming IFTA form is a tax return used by commercial motor carriers to report fuel usage and miles traveled in various jurisdictions. This form is part of the International Fuel Tax Agreement (IFTA), which simplifies the reporting of fuel taxes for interstate carriers.

Who needs to file the Wyoming IFTA form?

If you operate a qualified motor vehicle that travels in multiple states or provinces, you must file the Wyoming IFTA form. A qualified vehicle typically has a gross weight of over 26,000 pounds or has three or more axles, regardless of weight.

When is the Wyoming IFTA form due?

The Wyoming IFTA form is typically due on the last day of the month following the end of the reporting period. For example, if your reporting period ends on March 31, your form is due by April 30. It's crucial to stay on top of these deadlines to avoid penalties.

What information do I need to complete the Wyoming IFTA form?

You will need to gather information about total miles traveled, total gallons of fuel purchased, and the jurisdictions in which you operated. Additionally, you must provide details on the type of fuel used and any taxes paid in each jurisdiction.

What happens if I don’t file the Wyoming IFTA form on time?

Failing to file the form on time can result in penalties and interest charges. If you owe taxes, these fees can accumulate quickly, impacting your finances. It’s best to file on time to avoid these unnecessary costs.

Can I amend my Wyoming IFTA form?

Yes, if you discover an error after submitting your IFTA form, you can file an amended return. Ensure that you clearly indicate that it is an amended return and provide the correct information to avoid issues with your tax obligations.

What should I do if I had no operations during the reporting period?

If you had no operations during the reporting period, you should still file a return indicating "No Operations." This keeps your records up to date and ensures compliance with IFTA requirements.

How do I make a payment for the taxes due on the Wyoming IFTA form?

You can make your payment by check, payable to the Wyoming Department of Transportation. Be sure to include your IFTA account number on the check and mail it along with your completed form to the address provided on the form.

What if my total due is less than $10?

If your total due is less than $10, a billing notice will not be sent. However, you are still required to file your IFTA form to remain compliant, even if there is no payment necessary.

Where can I get help with the Wyoming IFTA form?

If you have questions or need assistance, you can call the Wyoming Department of Transportation at 307-777-4827. They can provide guidance and support to ensure your form is filled out correctly.

Amended Return

Amended Return