What is a Transfer-on-Death Deed in Wyoming?

A Transfer-on-Death Deed (TODD) is a legal document that allows property owners in Wyoming to transfer real estate to designated beneficiaries upon their death. This deed enables the owner to maintain full control of the property during their lifetime while ensuring a smooth transfer to heirs without the need for probate. It’s a straightforward way to pass on property without complications or delays.

Who can use a Transfer-on-Death Deed?

Any individual who owns real estate in Wyoming can utilize a Transfer-on-Death Deed. This includes single owners, married couples, and even joint owners. However, it’s important to ensure that the deed complies with state laws and that the property is eligible for this type of transfer.

How do I create a Transfer-on-Death Deed?

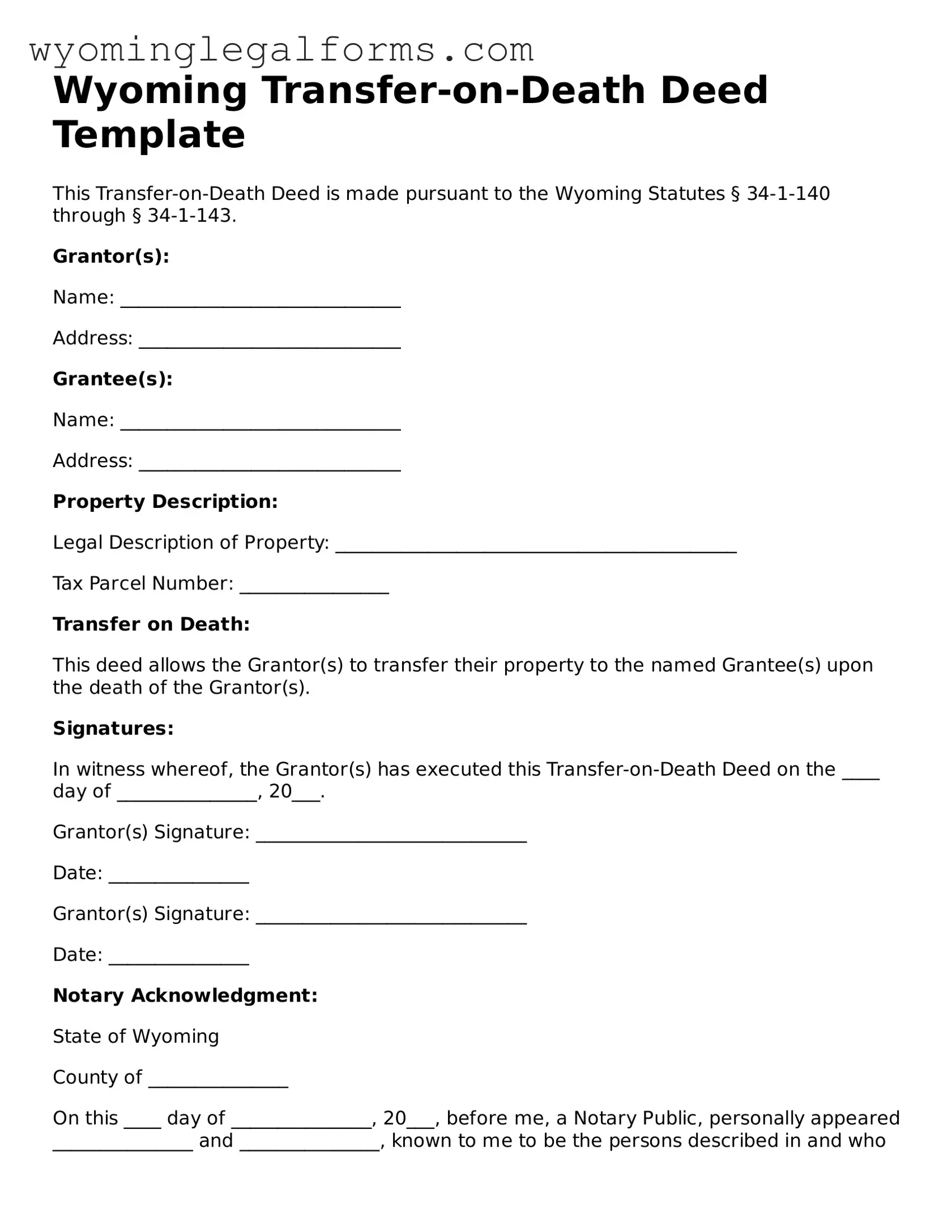

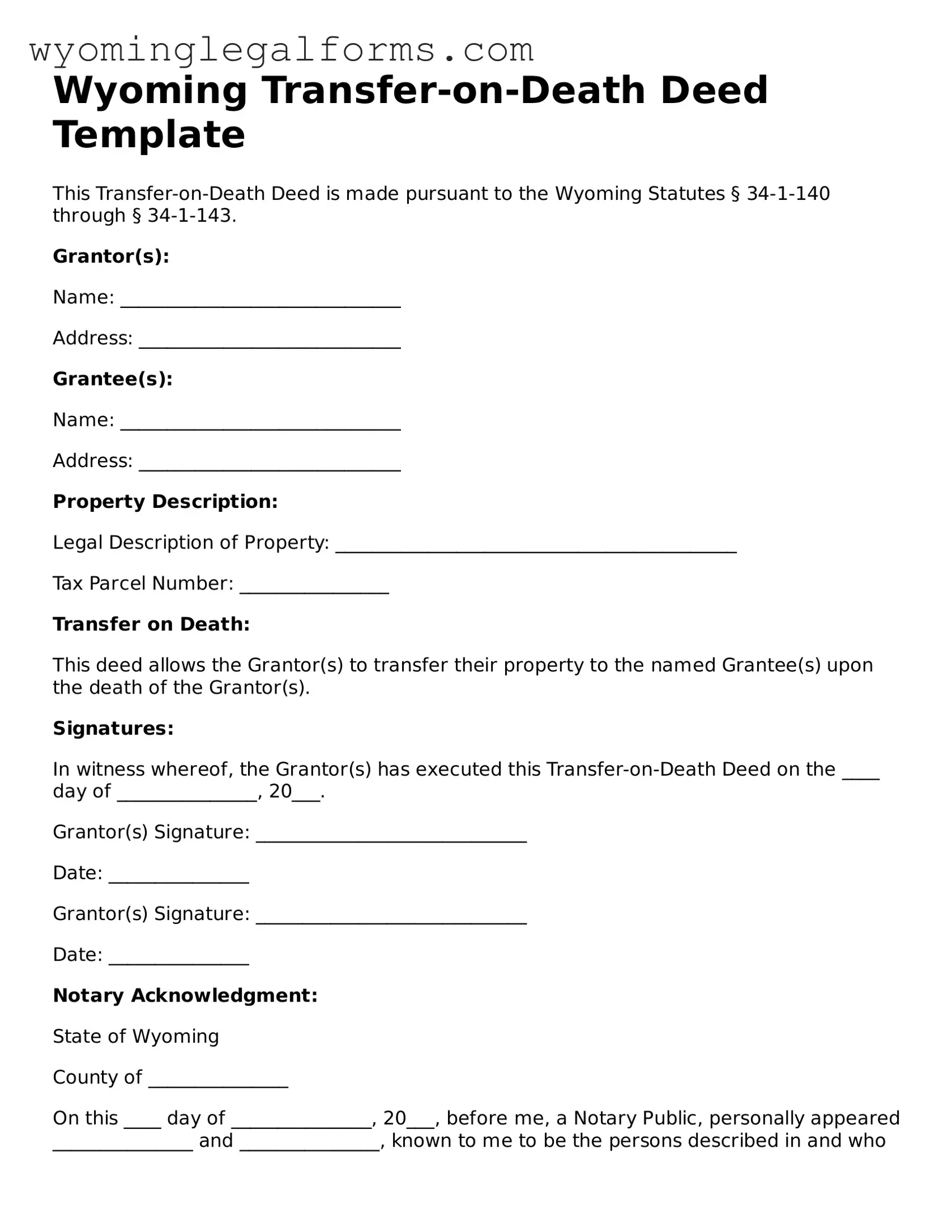

To create a Transfer-on-Death Deed, you need to fill out the appropriate form, which includes details about the property and the beneficiaries. It must be signed and notarized. After that, the deed should be recorded with the county clerk in the county where the property is located. This recording makes the deed legally effective and ensures that your wishes are documented.

Can I change or revoke a Transfer-on-Death Deed after it’s created?

Yes, you can change or revoke a Transfer-on-Death Deed at any time while you are still alive. To do this, you can either create a new deed that supersedes the previous one or file a revocation form with the county clerk. It’s essential to follow the proper procedures to ensure that your changes are legally recognized.

What happens if I don’t name a beneficiary in the Transfer-on-Death Deed?

If you do not name a beneficiary, the property will not transfer as intended. Instead, it will become part of your estate and may be subject to probate. To avoid complications, it’s crucial to designate at least one beneficiary when creating the deed.

Are there any tax implications for using a Transfer-on-Death Deed?

Generally, there are no immediate tax implications when using a Transfer-on-Death Deed. The property retains its tax basis, and beneficiaries typically do not incur taxes until they sell the property. However, it’s wise to consult a tax professional to understand any potential future tax consequences.

What types of property can be transferred using a Transfer-on-Death Deed?

In Wyoming, you can use a Transfer-on-Death Deed for most types of real estate, such as residential homes, land, and commercial properties. However, it cannot be used for personal property like vehicles or bank accounts. Always check local regulations to ensure compliance.

Is a Transfer-on-Death Deed the same as a will?

No, a Transfer-on-Death Deed is not the same as a will. While both documents deal with the distribution of property after death, a Transfer-on-Death Deed specifically transfers real estate outside of probate, whereas a will typically goes through the probate process. This distinction can save time and money for your beneficiaries.

Can I use a Transfer-on-Death Deed for multiple properties?

Yes, you can create separate Transfer-on-Death Deeds for multiple properties. Each deed must be executed and recorded individually. Ensure that each deed clearly identifies the specific property and the beneficiaries to avoid any confusion during the transfer process.