What is a Wyoming Small Estate Affidavit?

The Wyoming Small Estate Affidavit is a legal document that allows heirs to claim the assets of a deceased person without going through the formal probate process. This option is available when the total value of the estate is below a certain threshold, making it easier and quicker for heirs to access the deceased's property and assets.

Who can use the Small Estate Affidavit in Wyoming?

Any individual who is an heir or beneficiary of the deceased can use the Small Estate Affidavit. However, it is important to note that the total value of the estate must be under the statutory limit set by Wyoming law. This typically includes assets like bank accounts, personal property, and real estate, but excludes certain types of property, such as jointly owned assets.

What is the value limit for a small estate in Wyoming?

As of the latest guidelines, the value limit for a small estate in Wyoming is $200,000. This amount can change, so it is advisable to verify the current limit before proceeding. If the estate's value exceeds this threshold, the formal probate process may be required.

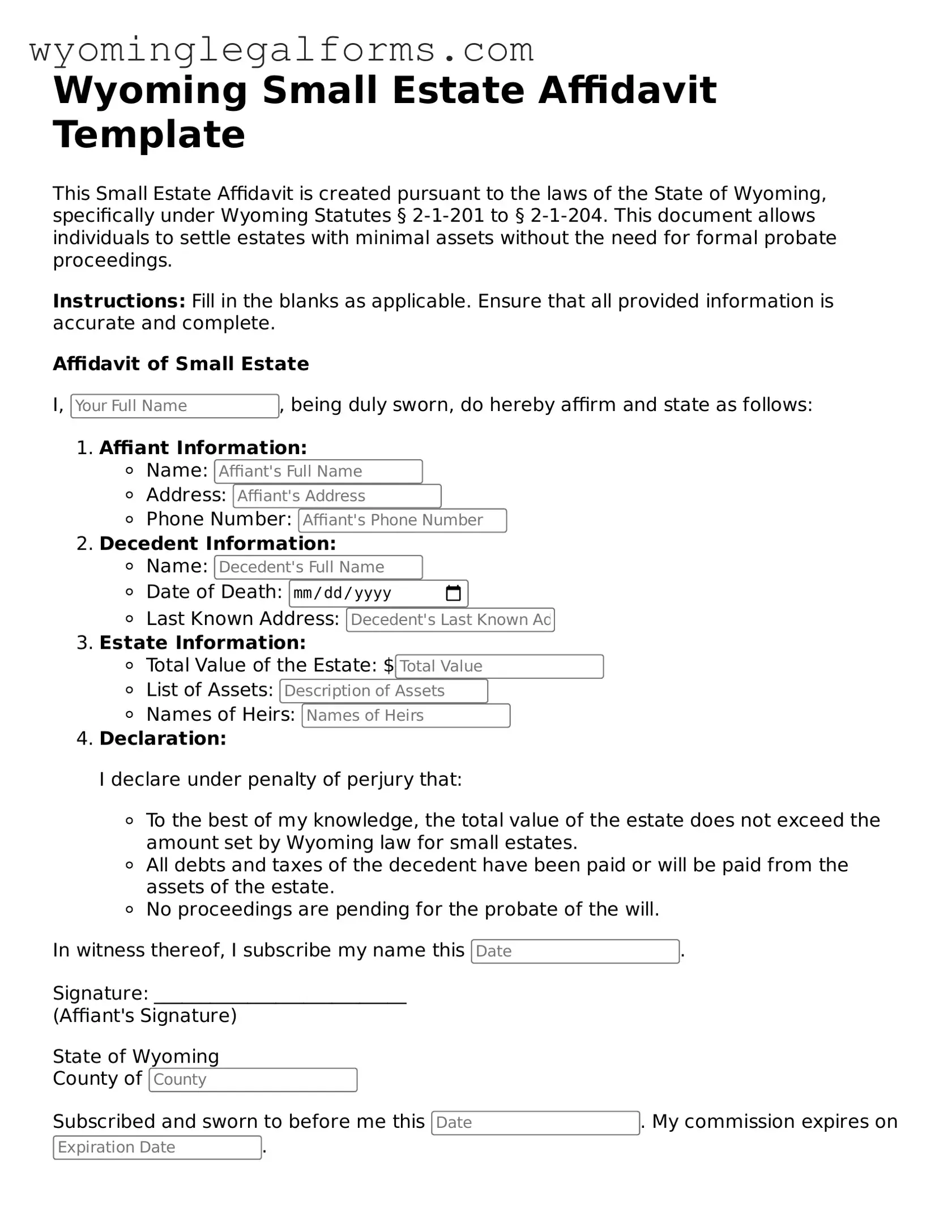

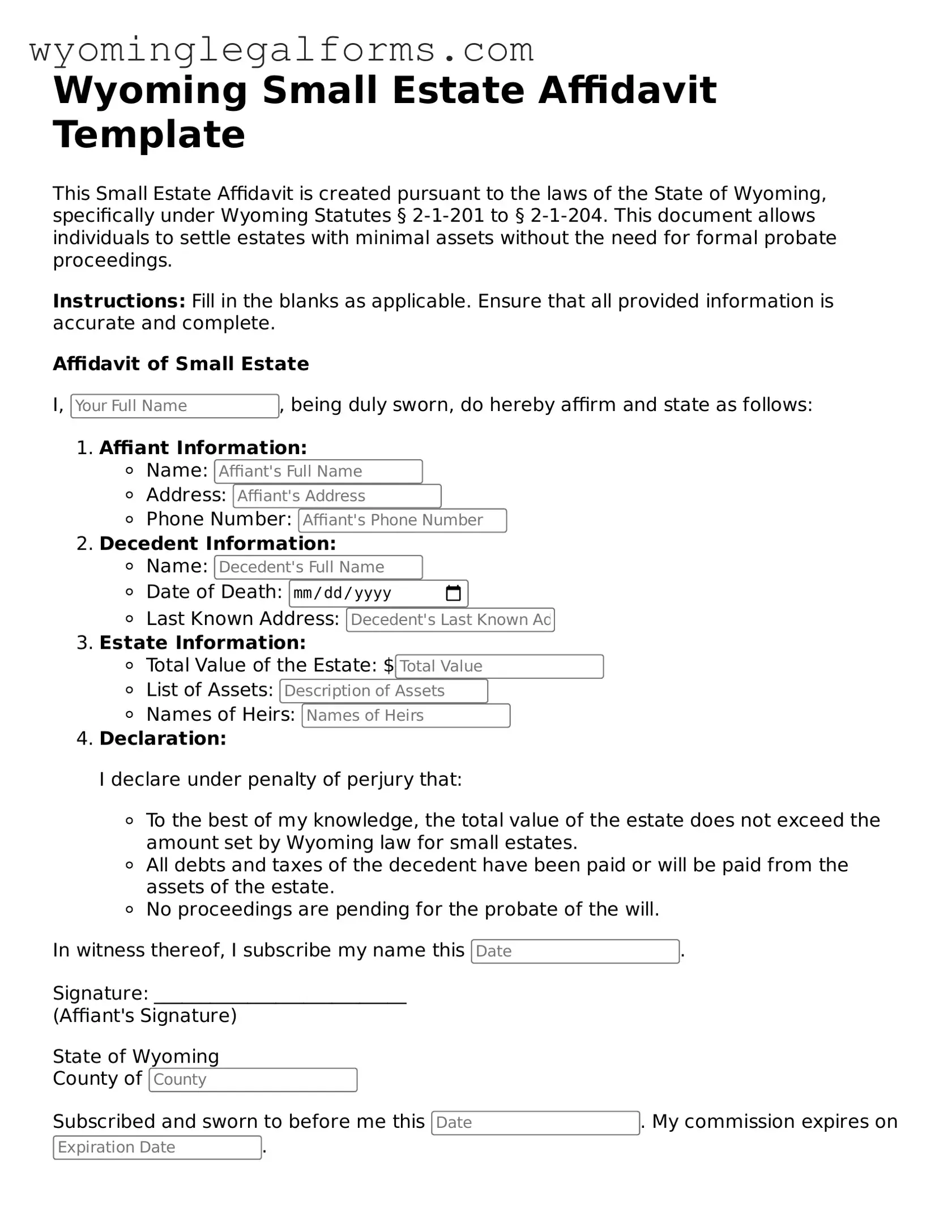

How do I complete the Small Estate Affidavit?

To complete the Small Estate Affidavit, you will need to gather information about the deceased, including their name, date of death, and details of the assets. The affidavit must be signed under oath, typically in front of a notary public. It is essential to provide accurate and complete information to avoid any legal complications.

Where do I file the Small Estate Affidavit?

The completed Small Estate Affidavit should be filed with the county clerk in the county where the deceased lived at the time of their death. This filing allows the affidavit to become part of the public record, providing legal authority to access the deceased's assets.

What happens after filing the Small Estate Affidavit?

Once the Small Estate Affidavit is filed, the heirs can use it to claim the assets of the deceased. Financial institutions and other entities holding the deceased's assets may require a copy of the affidavit to release funds or transfer property. The process is generally straightforward, but patience may be necessary as institutions process the documents.

Are there any fees associated with filing the Small Estate Affidavit?

Yes, there may be filing fees associated with submitting the Small Estate Affidavit. These fees can vary by county, so it is advisable to check with the local county clerk's office for specific amounts. Additionally, there may be fees for notarization or obtaining copies of the affidavit.

Can I contest a Small Estate Affidavit?

Yes, it is possible to contest a Small Estate Affidavit. If someone believes that the affidavit was filed improperly or that they have a rightful claim to the estate, they may challenge it in court. This typically requires legal representation and can involve a more complex legal process.