What is a Wyoming Promissory Note?

A Wyoming Promissory Note is a legal document that outlines a borrower's promise to repay a loan to a lender. It includes details such as the loan amount, interest rate, repayment schedule, and any penalties for late payments. This document serves as a record of the agreement between the two parties.

Who uses a Promissory Note in Wyoming?

Individuals and businesses in Wyoming use Promissory Notes. They are commonly used in personal loans, business loans, and real estate transactions. Essentially, anyone who lends or borrows money can benefit from having a clear, written agreement.

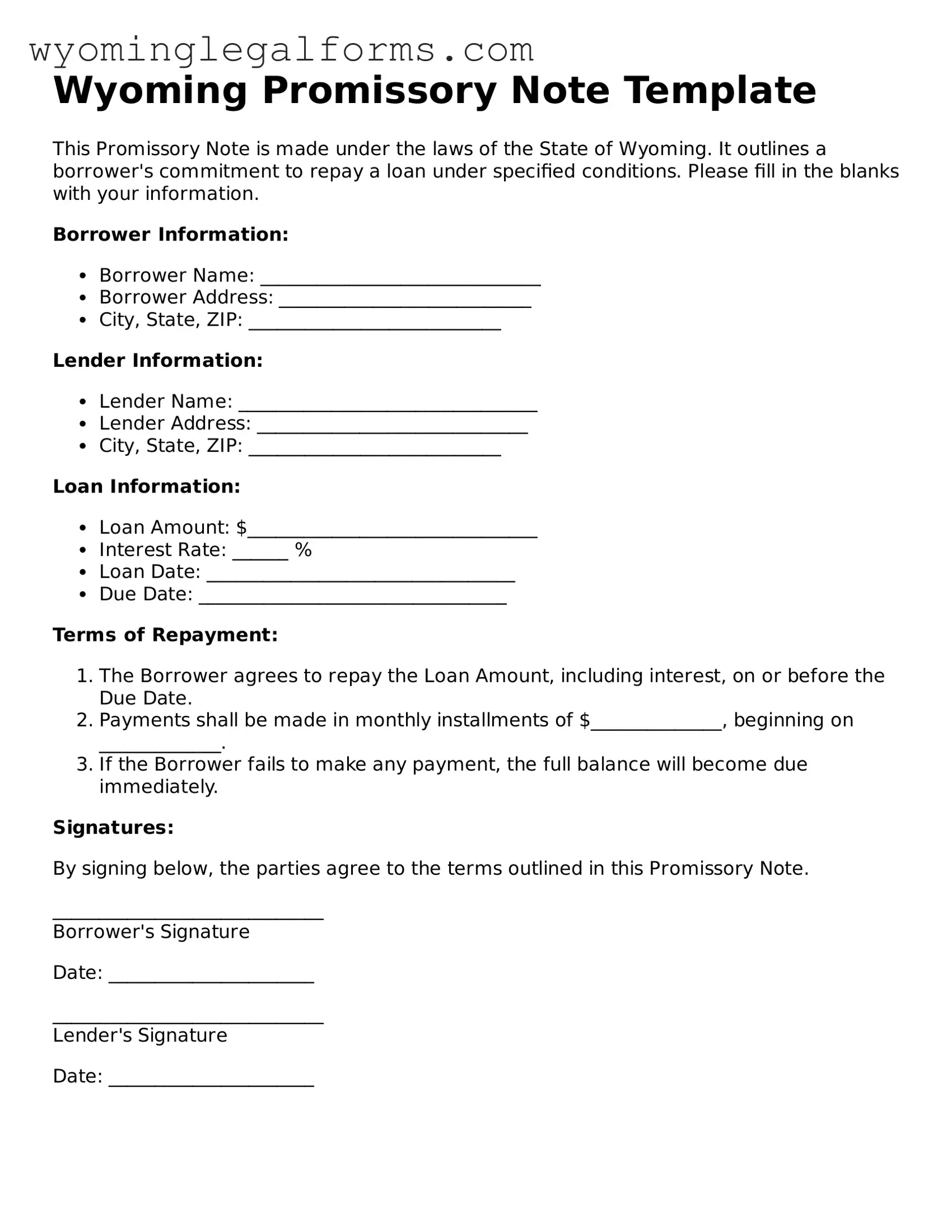

What should be included in a Wyoming Promissory Note?

A well-drafted Promissory Note should include the following: the names and addresses of the borrower and lender, the principal amount of the loan, the interest rate, the repayment schedule, any late fees, and the date the loan is due. It may also include provisions for default and remedies available to the lender.

Is a Promissory Note legally binding in Wyoming?

Yes, a Promissory Note is legally binding in Wyoming as long as it meets certain requirements. Both parties must agree to the terms, and the document must be signed by the borrower. It’s important to ensure that the terms are clear and that both parties understand their obligations.

Can a Promissory Note be modified after it is signed?

Yes, a Promissory Note can be modified after it is signed, but both parties must agree to the changes. It’s advisable to document any modifications in writing and have both parties sign the updated terms to avoid confusion later.

What happens if the borrower defaults on the Promissory Note?

If the borrower defaults, the lender has the right to take action as outlined in the Promissory Note. This could include charging late fees, demanding immediate payment of the remaining balance, or taking legal action to recover the owed amount. The specific remedies will depend on the terms agreed upon in the note.

Do I need a lawyer to create a Promissory Note in Wyoming?

While it’s not legally required to have a lawyer draft a Promissory Note, it can be beneficial. A lawyer can ensure that the document complies with state laws and adequately protects your interests. If you’re unsure about the terms or conditions, seeking legal advice is a good idea.

Can a Promissory Note be used for business loans?

Yes, a Promissory Note is often used for business loans. It provides a clear framework for repayment and can help establish trust between the lender and borrower. Just like personal loans, the terms should be clearly defined to avoid misunderstandings.

Where can I find a template for a Wyoming Promissory Note?

Templates for a Wyoming Promissory Note can be found online through legal document websites, or you can consult with a lawyer who can provide a customized template based on your specific needs. Ensure that any template you use complies with Wyoming law.