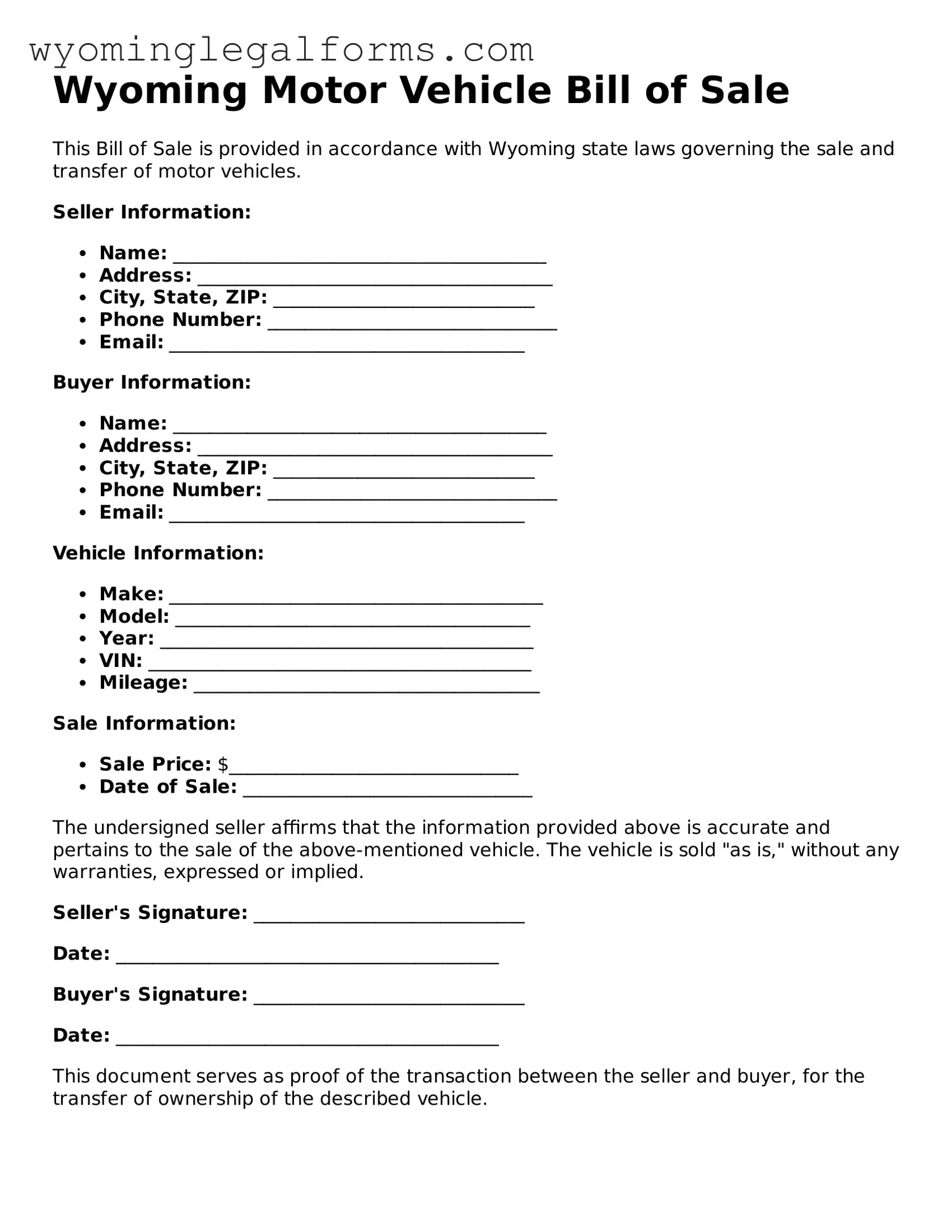

What is a Wyoming Motor Vehicle Bill of Sale?

A Wyoming Motor Vehicle Bill of Sale is a legal document that records the transfer of ownership of a motor vehicle from one party to another. It serves as proof of the transaction and includes important details about the vehicle, the seller, and the buyer. This document is essential for both parties to ensure a smooth transfer of ownership and to protect their rights in the process.

Why do I need a Bill of Sale for a vehicle in Wyoming?

In Wyoming, a Bill of Sale is not legally required for every vehicle transaction. However, it is highly recommended. This document provides evidence of the sale, which can be crucial for tax purposes, registration, and insurance. It helps to establish the date of the sale and the agreed-upon price, which can be important if any disputes arise later.

What information should be included in the Bill of Sale?

A comprehensive Bill of Sale should include several key pieces of information. This includes the names and addresses of both the seller and the buyer, the vehicle identification number (VIN), the make, model, and year of the vehicle, the sale price, and the date of the transaction. Additionally, it may be helpful to include any warranties or conditions related to the sale.

Is the Bill of Sale the same as the title?

No, the Bill of Sale and the title are not the same. The title is the official document that proves ownership of the vehicle. The Bill of Sale, on the other hand, is a record of the transaction. While the title must be signed over to the new owner to complete the transfer, the Bill of Sale acts as a receipt and can help document the sale for both parties.

Do I need to have the Bill of Sale notarized?

In Wyoming, notarization of the Bill of Sale is not required. However, having the document notarized can provide an extra layer of security and validation. It can help prevent disputes by confirming that both parties willingly entered into the agreement. If either party wishes to have the document notarized, they may do so, but it is not a legal necessity.

What should I do with the Bill of Sale after the sale?

After the sale is completed, both the buyer and the seller should keep a copy of the Bill of Sale for their records. The buyer may need it when registering the vehicle with the Wyoming Department of Transportation. It can also be useful for tax purposes and to prove ownership in the future. Sellers should retain it in case any issues arise regarding the sale.

Can I create my own Bill of Sale, or do I need to use a specific form?

You can create your own Bill of Sale as long as it includes all the necessary information. There are also templates available online that you can use to ensure that all required details are included. While using a specific form can simplify the process, it is not mandatory as long as the document serves its purpose and contains the essential information.

What if the vehicle has a loan or lien on it?

If the vehicle has a loan or lien, the seller must address this before completing the sale. The lienholder must be paid off, and the lien released to transfer clear title to the buyer. It is advisable for both parties to verify that the lien has been cleared and to include any relevant information in the Bill of Sale to avoid future complications.

Are there any fees associated with the Bill of Sale?

There are typically no fees associated with creating a Bill of Sale itself. However, there may be fees related to vehicle registration or title transfer that the buyer will need to pay when they take the vehicle to the Department of Transportation. These fees can vary based on the vehicle's value and the specific circumstances of the sale.

What if I lose the Bill of Sale?

If you lose the Bill of Sale, it may be difficult to prove the transaction took place. However, both parties can create a duplicate Bill of Sale if they have the necessary information. It is advisable to keep multiple copies of important documents like this in a safe place to avoid complications in the future.