1. What is the Joint Registration Wyoming form?

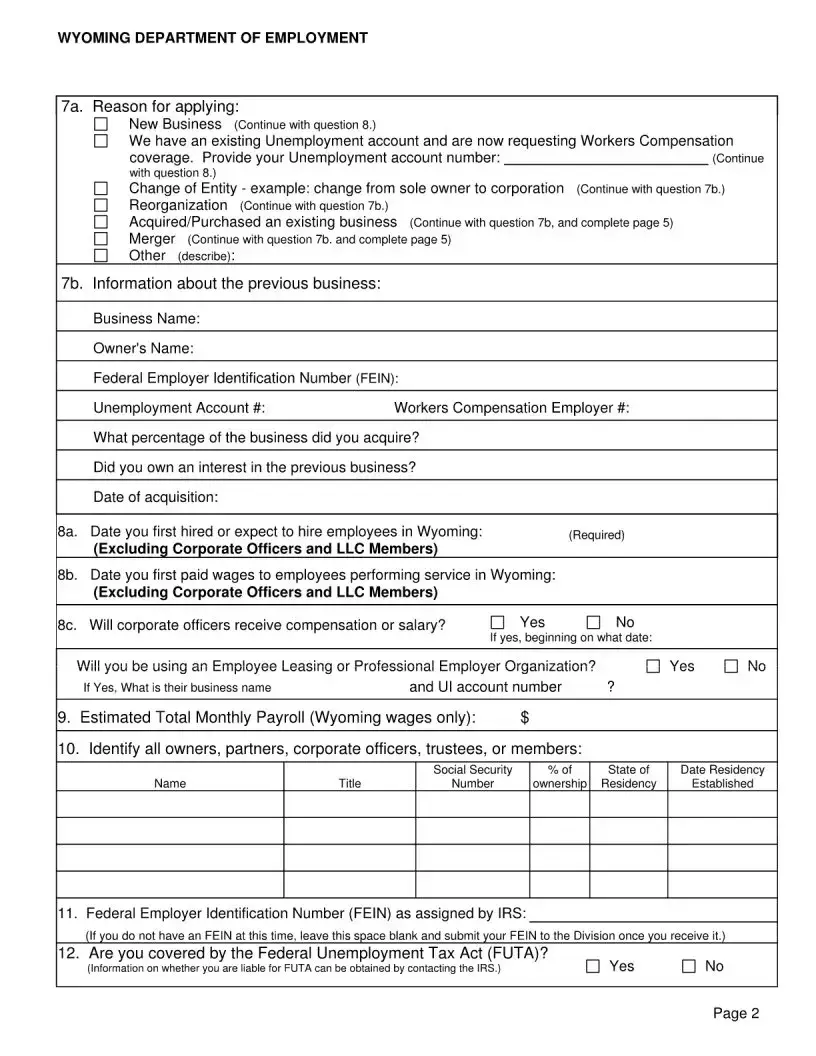

The Joint Registration Wyoming form is a single application that allows businesses to apply for both Unemployment Insurance and Workers' Compensation accounts in Wyoming. By completing this form, you can streamline the registration process for these essential business accounts.

2. Who needs to fill out this form?

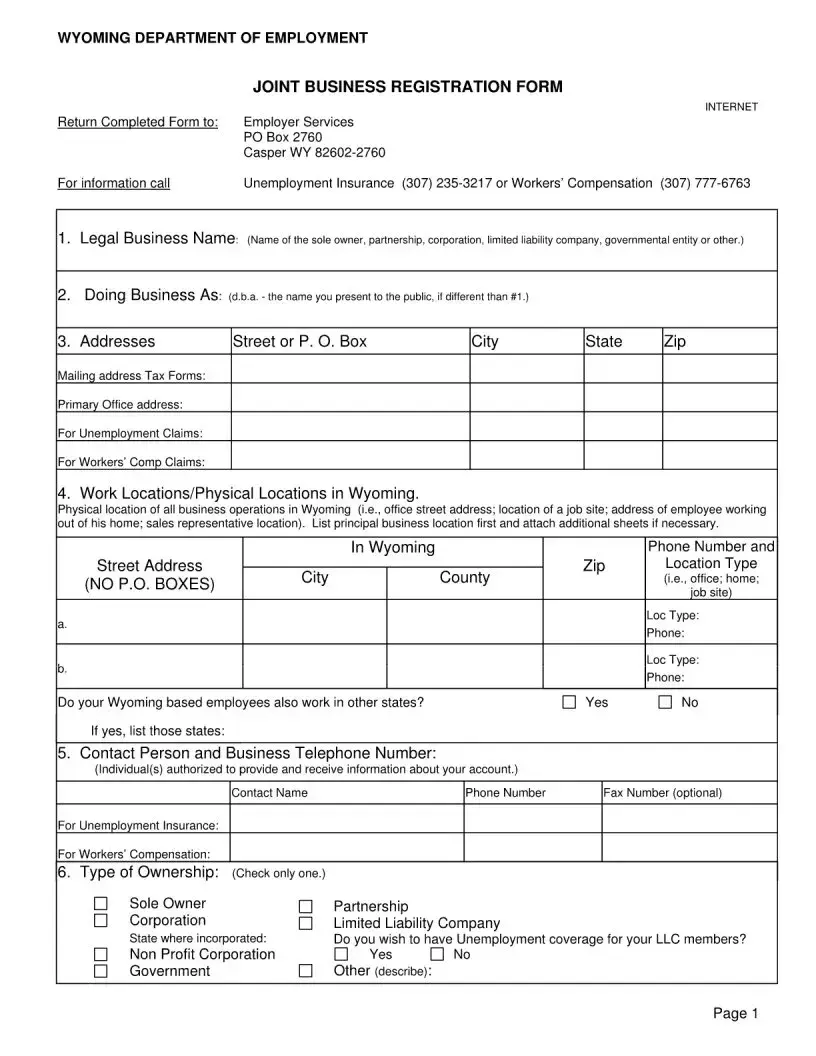

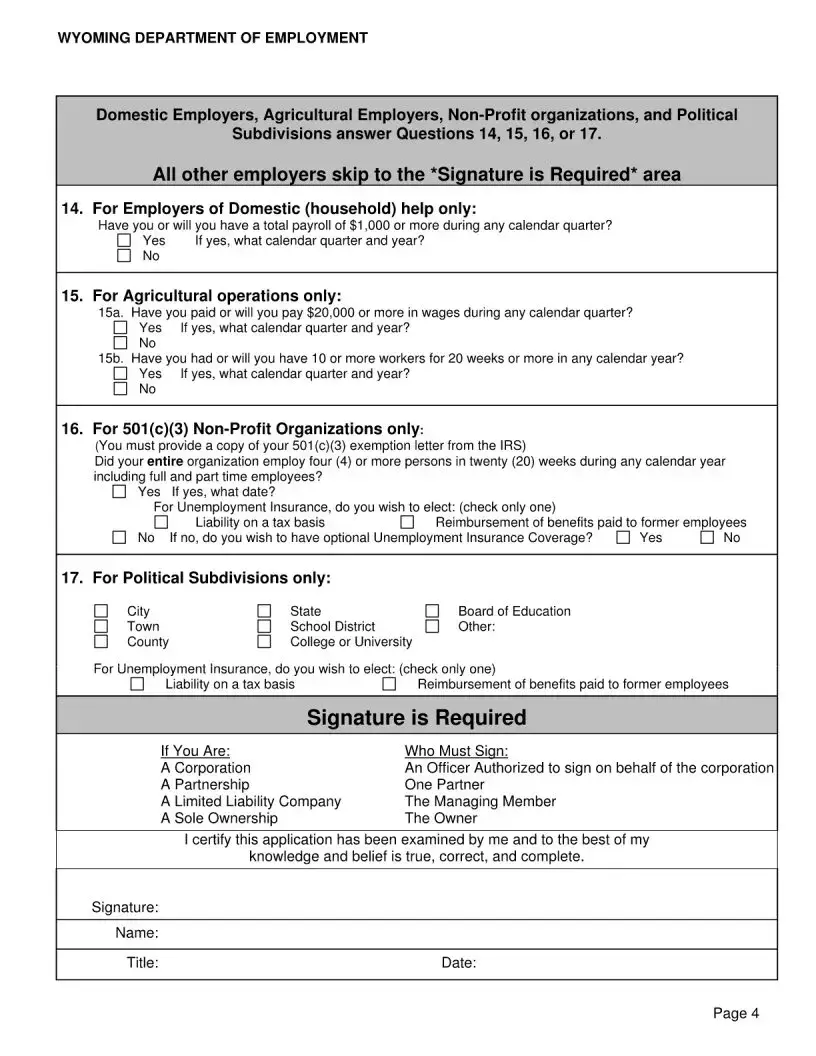

This form is required for any business operating in Wyoming that needs to register for Unemployment Insurance and Workers' Compensation. This includes sole proprietors, partnerships, corporations, limited liability companies, and governmental entities.

3. How long does it take to process the application?

Processing your application will take a minimum of three weeks. This timeline begins only after the signed paper copy of the form is received. Incomplete applications will cause delays, so it’s important to fill out the form accurately and completely.

4. Where should I send the completed form?

You must mail the completed Joint Registration Wyoming form to the Unemployment Tax Division, Employer Services at P.O. Box 2760, Casper, WY 82602. Faxes will not be accepted, so ensure you send the paper copy by mail.

5. What happens if I submit an incomplete application?

If your application is incomplete, it will be returned to you. This will lead to further delays in processing and could result in penalties. To avoid this, double-check that all sections of the form are filled out correctly before submission.

6. Can I apply if I already have an Unemployment account?

Yes, if you already have an existing Unemployment account and are seeking Workers' Compensation coverage, you can still use this form. Make sure to provide your Unemployment account number in the designated section of the application.

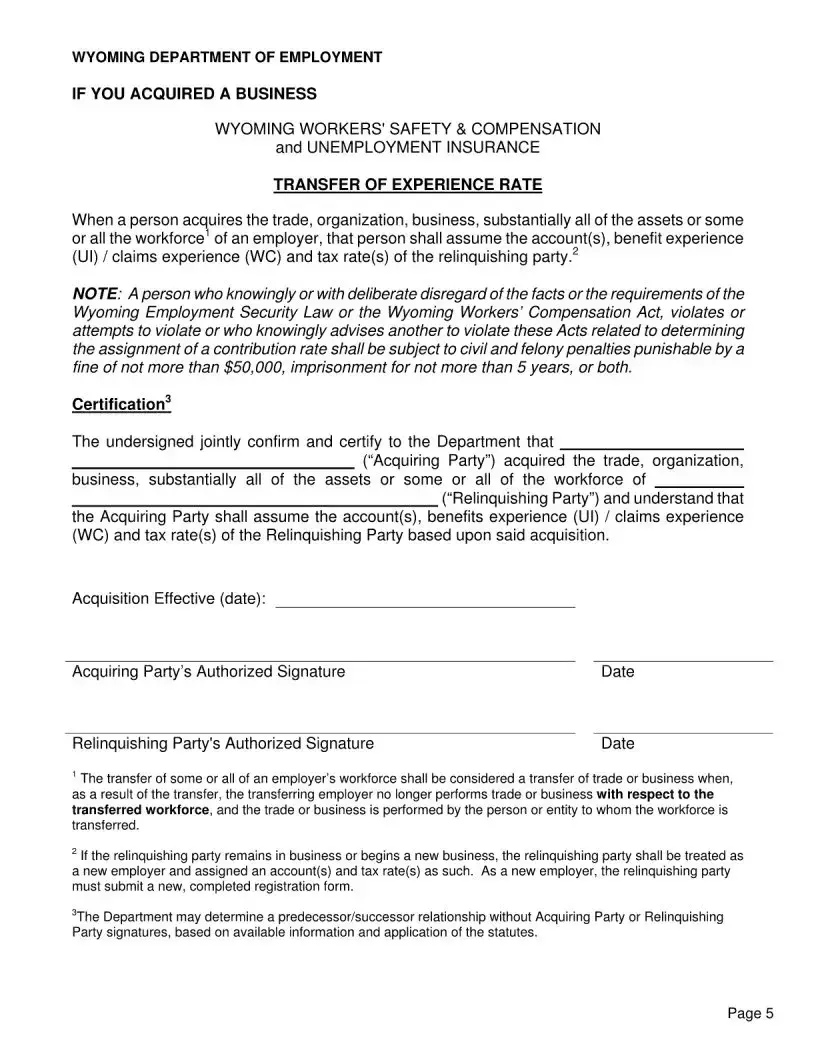

7. Is there a penalty for providing false information?

Yes, providing false information on this form can lead to serious consequences. Violations of the Wyoming Employment Security Law or the Wyoming Workers' Compensation Act can result in civil and felony penalties, including fines and imprisonment.

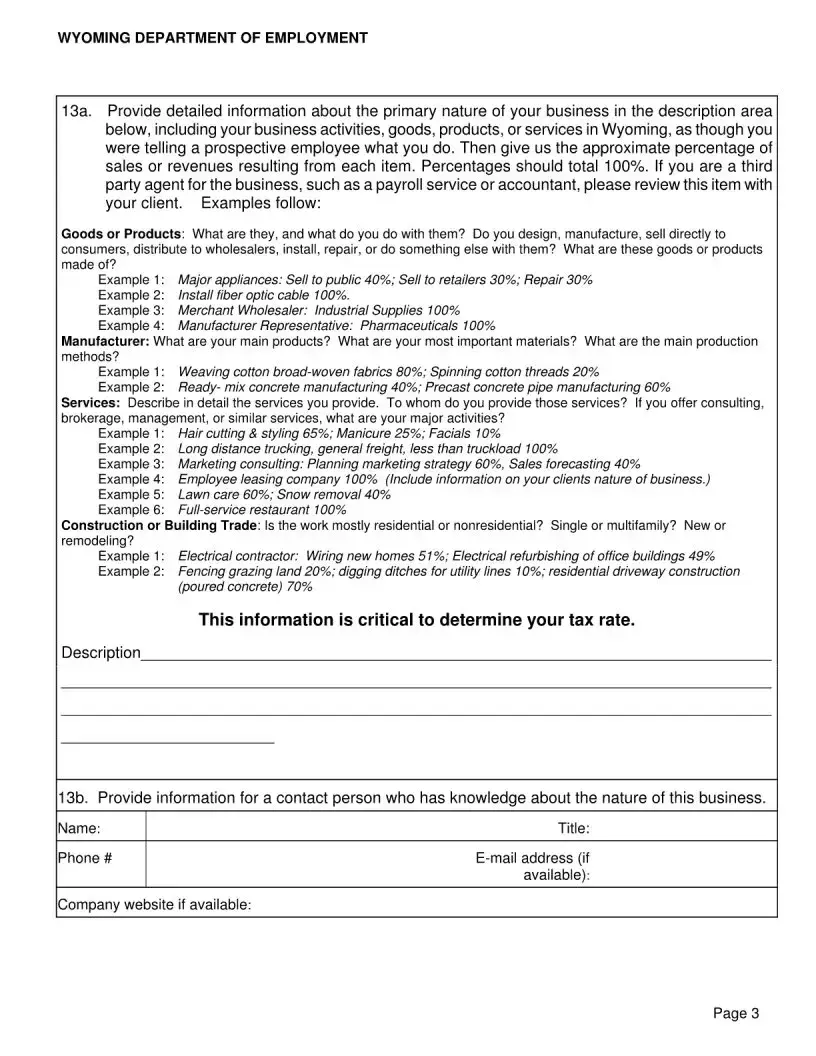

8. What information do I need to provide about my business?

You will need to provide various details, including your business name, addresses, type of ownership, estimated payroll, and a description of your business activities. This information helps determine your tax rate and ensures compliance with state regulations.

9. Do I need a Federal Employer Identification Number (FEIN) to apply?

While having a FEIN is beneficial, it is not mandatory at the time of application. If you do not have one yet, leave that section blank and submit it to the Division once you receive it.

10. How can I get more information or assistance with the form?

If you have questions or need assistance, you can contact Employer Services at the Wyoming Department of Employment. For Unemployment Insurance inquiries, call (307) 235-3217. For Workers’ Compensation questions, reach out at (307) 777-6763.