What is a Wyoming Bill of Sale form?

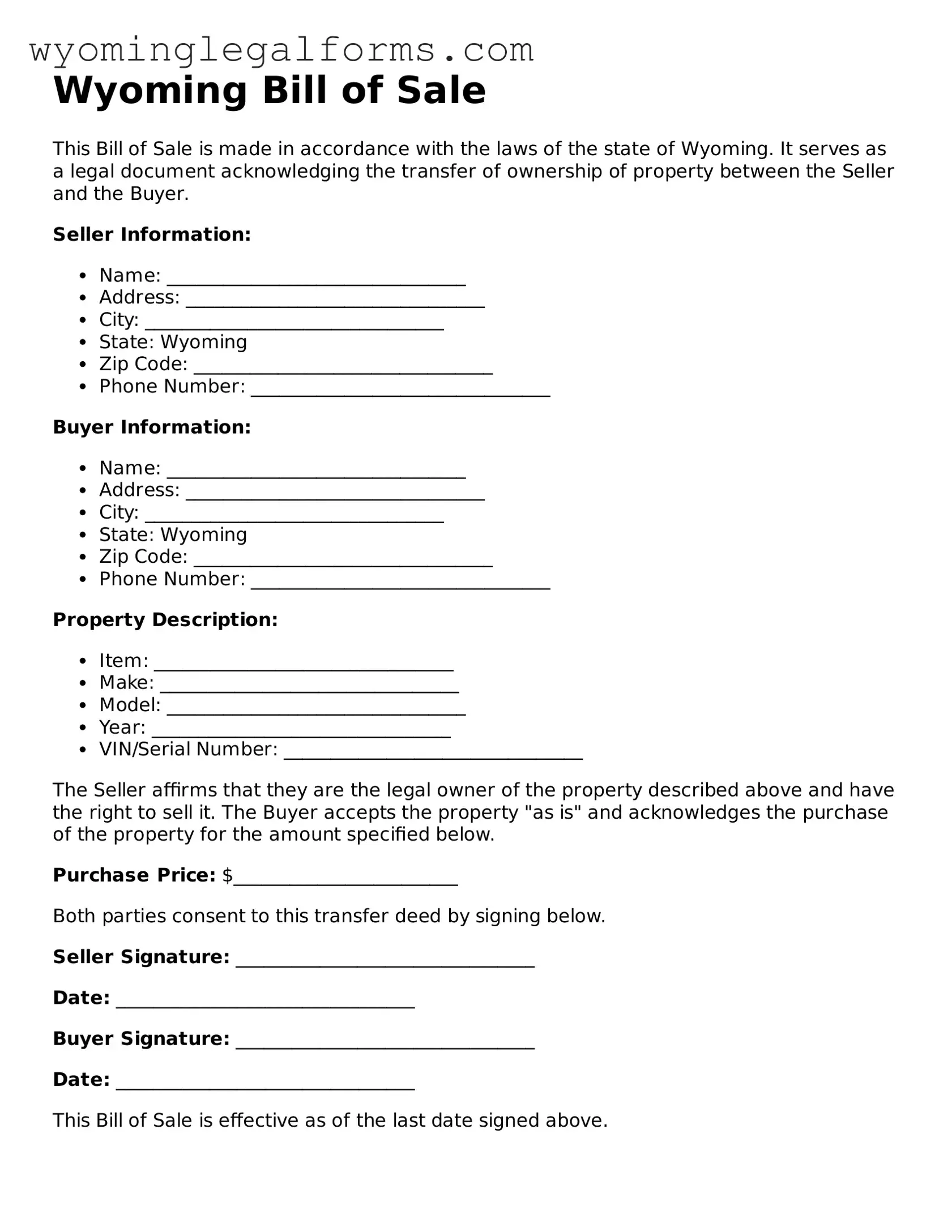

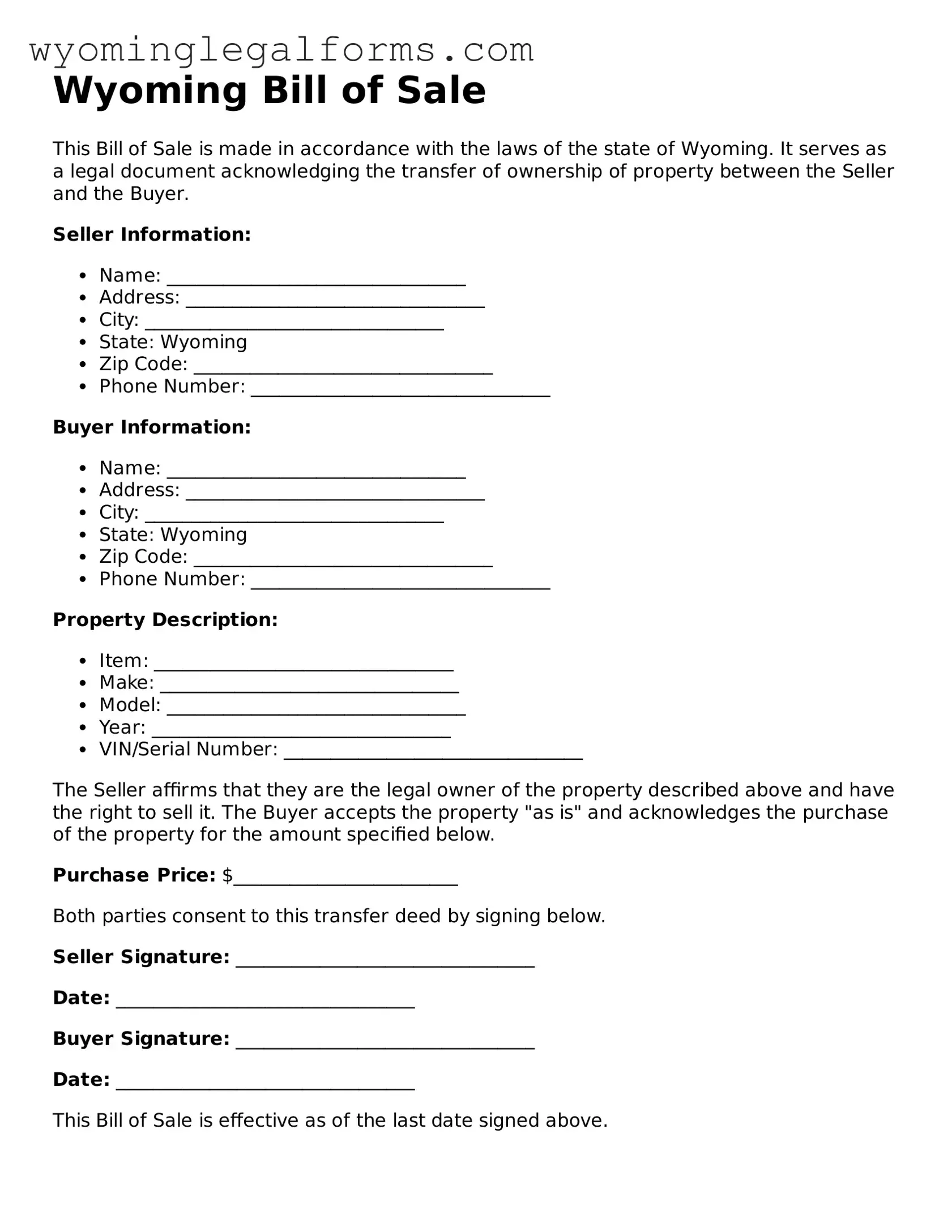

A Wyoming Bill of Sale form is a legal document that records the transfer of ownership of personal property from one person to another. This form serves as proof of the transaction and includes details about the buyer, seller, and the item being sold. It can be used for various types of property, including vehicles, boats, and equipment.

Is a Bill of Sale required in Wyoming?

While a Bill of Sale is not legally required for every transaction in Wyoming, it is highly recommended. Having a Bill of Sale provides clear documentation of the sale, which can be useful for both parties in case of disputes or for future reference. For vehicles, a Bill of Sale is often necessary for registration purposes.

What information should be included in a Wyoming Bill of Sale?

A complete Wyoming Bill of Sale should include the names and addresses of both the buyer and seller, a description of the item being sold (including make, model, and VIN for vehicles), the sale price, and the date of the transaction. Additionally, both parties should sign the document to validate the agreement.

Can a Bill of Sale be used for a vehicle in Wyoming?

Yes, a Bill of Sale is commonly used for vehicle transactions in Wyoming. It provides essential information needed for the buyer to register the vehicle with the state. It's important to ensure that the Bill of Sale includes all necessary details, such as the vehicle identification number (VIN) and odometer reading.

Do I need to have the Bill of Sale notarized in Wyoming?

Notarization is not required for a Bill of Sale in Wyoming. However, having the document notarized can add an extra layer of security and authenticity to the transaction. It can help prevent disputes by verifying the identities of both parties involved in the sale.

Where can I obtain a Wyoming Bill of Sale form?

You can obtain a Wyoming Bill of Sale form from various sources, including online legal document providers, local government offices, or legal stationery stores. Ensure that the form you choose meets the specific requirements for your transaction type to ensure its validity.