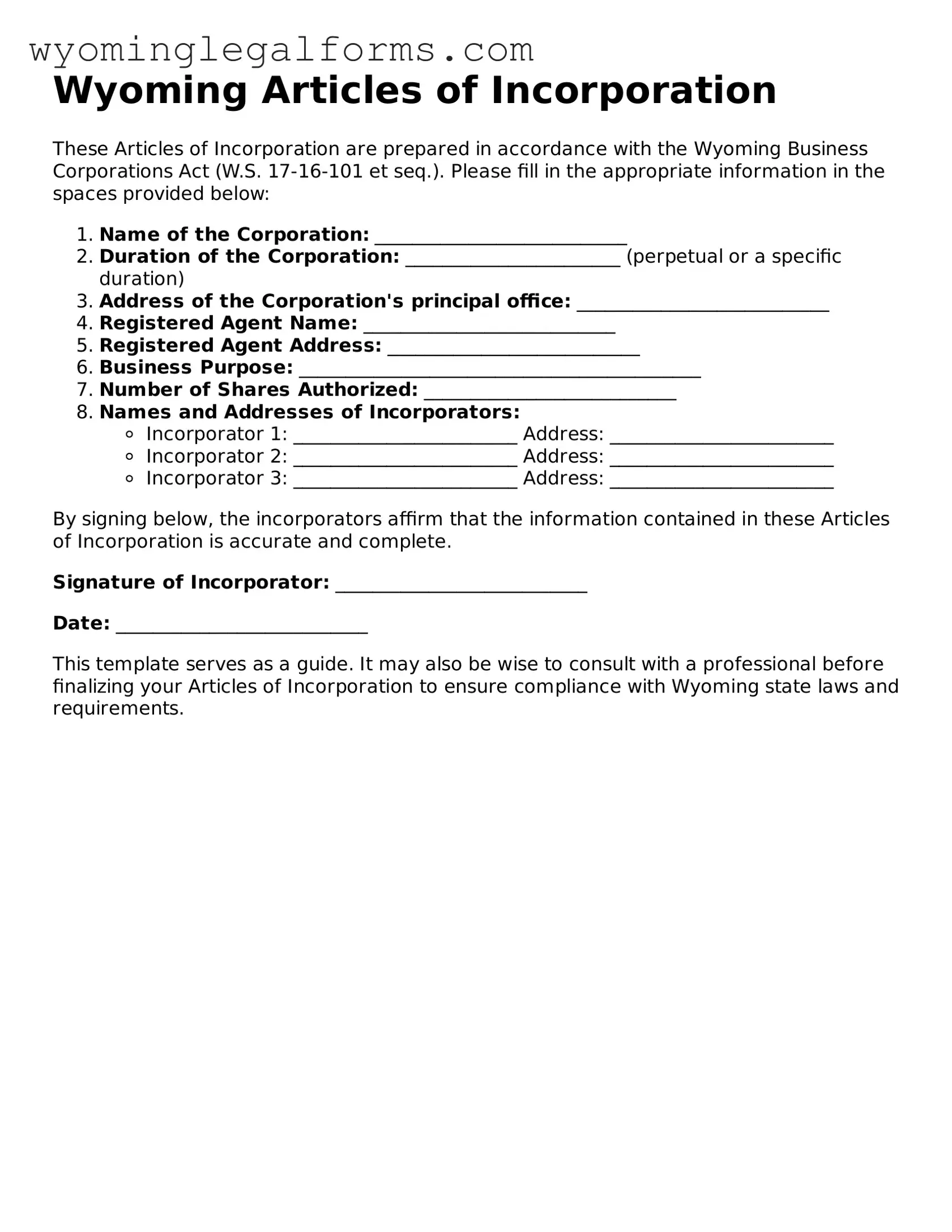

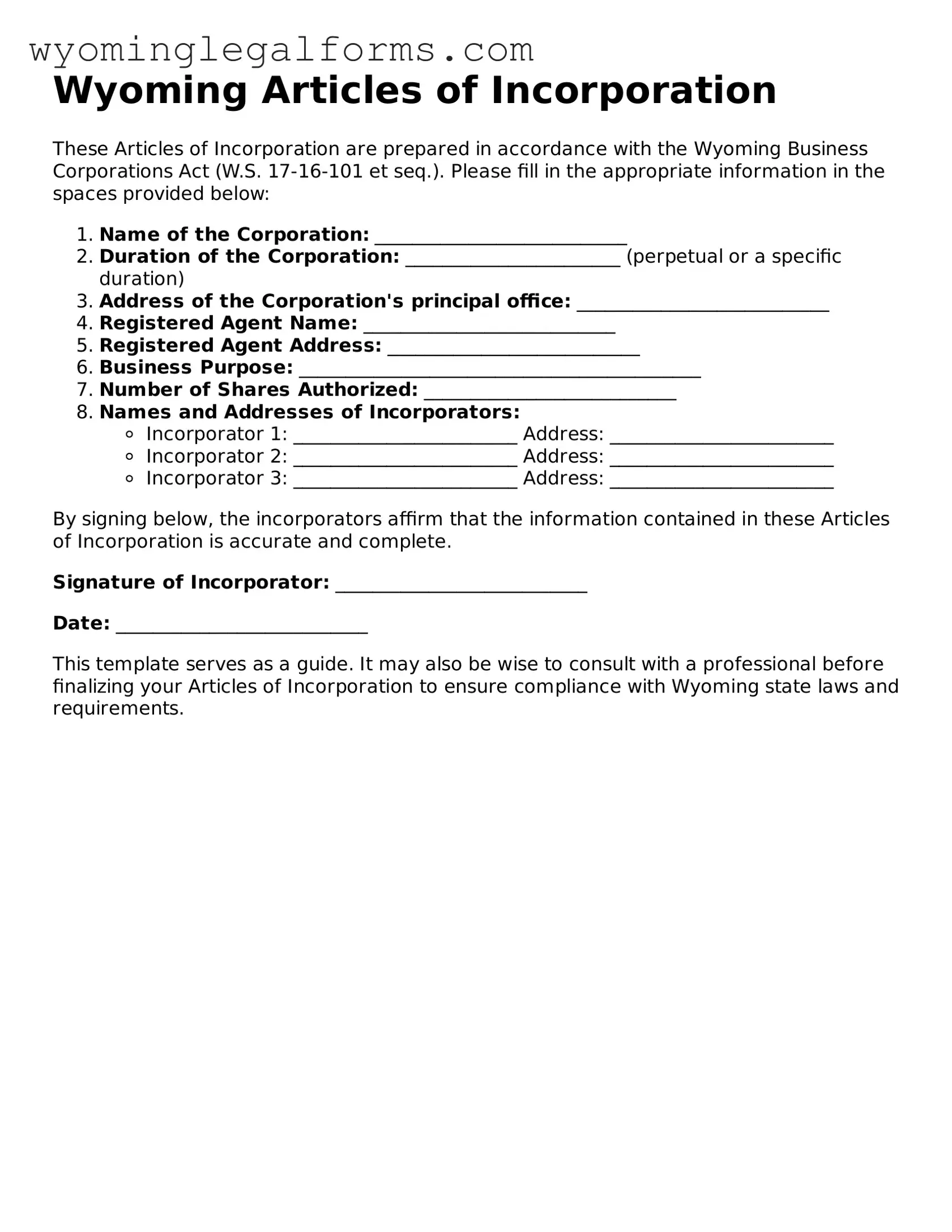

What is the Wyoming Articles of Incorporation form?

The Wyoming Articles of Incorporation form is a legal document that establishes a corporation in Wyoming. This form includes essential information about the corporation, such as its name, purpose, registered agent, and the number of shares it is authorized to issue. Filing this form is a crucial step in forming a corporation in the state.

Who needs to file the Articles of Incorporation?

Any individual or group looking to create a corporation in Wyoming must file the Articles of Incorporation. This includes businesses of all sizes and types, whether they are for-profit or nonprofit. It is important to ensure that all required information is accurate and complete to avoid delays in the incorporation process.

How do I complete the Articles of Incorporation form?

To complete the Articles of Incorporation form, you will need to provide specific information about your corporation. This includes the corporation's name, the purpose of the business, the address of the registered office, the name and address of the registered agent, and details about the shares. Make sure to follow the instructions carefully and double-check all entries for accuracy.

Where do I submit the Articles of Incorporation?

The completed Articles of Incorporation form must be submitted to the Wyoming Secretary of State. You can file the form online, by mail, or in person. If filing by mail, be sure to send it to the appropriate address and include any required fees to ensure your application is processed promptly.

What is the filing fee for the Articles of Incorporation?

The filing fee for the Articles of Incorporation in Wyoming varies depending on the type of corporation you are forming. Generally, the fee is around $100 for a standard corporation. Additional fees may apply if you choose expedited processing or if you are filing for a specific type of corporation, such as a nonprofit.

How long does it take to process the Articles of Incorporation?

The processing time for the Articles of Incorporation can vary. Typically, it takes about 2 to 3 business days for online submissions. Mail submissions may take longer, so it is advisable to allow for extra time. If you need your incorporation to be processed quickly, consider using expedited services if available.